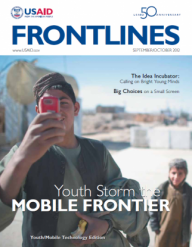

An Afghan youth uses his mobile phone to take pictures in Musa Qala, Jan. 18, 2011.

Dmitry Kostyukov, AFP

An Afghan youth uses his mobile phone to take pictures in Musa Qala, Jan. 18, 2011.

Dmitry Kostyukov, AFP

An Afghan youth uses his mobile phone to take pictures in Musa Qala, Jan. 18, 2011.

Dmitry Kostyukov, AFP

An Afghan youth uses his mobile phone to take pictures in Musa Qala, Jan. 18, 2011.

Dmitry Kostyukov, AFP

Just a decade ago, Afghans had to travel to Pakistan to make international calls. The landline phone infrastructure had completely fallen into disarray during the civil war, and there were no mobile phone operators. The first American diplomats and U.N. workers to return to Kabul after the fall of the Taliban carried backpacks full of costly satellite phones for the new Afghan emergency government.

But smart, early regulatory decisions by Afghan lawmakers, based on technical assistanczze from USAID and other donors, engendered the rapid growth of a profitable and competitive sector, pushing down airtime prices well within reach of normal Afghans. Today, Afghanistan is awash in mobile phones, with more than 18 million active subscriptions in a country of 28 million.

This explosion of mobile users has created a network that bridges the country’s formidable urban-rural divide while transcending gaps in physical infrastructure, low literacy rates and pervasive insecurity.

The near-ubiquity of mobile phone coverage has allowed Afghanistan to join the vanguard of countries experimenting with innovative new uses for the mobile channel, using the networks to extend services and information cheaply to populations lacking access through other means. Among the most promising is mobile money—the ability to safely store and transfer “e-money” via SMS, avoiding the expense and danger associated with moving cash, while extending the reach of basic financial services from the 5 percent of the population with accounts in brick-and-mortar banks to the 65 percent of Afghans who use mobile phones.

Already, m-money trials facilitated by the U.S. Government, such as paying government salaries by mobile instead of cash, are demonstrating startling benefits: In Wardak province, police deployed in unbanked communities report “raises” of 30 percent when paid via mobile; cash payments of salaries in Afghanistan are exceedingly vulnerable to corruption. Equally promising applications to extend and repay micro loans and pay household electricity bills are beginning to roll out, delivering dramatic increases in efficiency.

As the mobile network operators increasingly focus on scaling their mobile money products and agent networks, USAID is working in partnership with the private sector to aggregate demand and provide consumer education to Afghans, most of whom are unfamiliar with or mistrustful of the formal banking system. In one novel approach, the Agency is working with the Association of Mobile Money Operators of Afghanistan to harness the creativity and energy of Afghanistan’s best and brightest to develop mobile money applications to address pressing problems faced daily by Afghans.

An Afghan Avalanche of Ideas

The overwhelming response to an app design competition this year among Afghan university students illustrated just how compelling up-and-coming young Afghans find mobile money—more than 5,000 students across the country submitted ideas, many of which focused on how mobile money on how mobile money could improve the Afghan Government’s ability to provide basic services transparently and efficiently.

Others put forward ways in which mobile money could help empower individuals by giving them tools to manage their own finances, a particular boon for women, who often rely on male relatives to conduct financial transactions on their behalf.

Such competitions can trigger a network effect, drawing students into the design process and drawing in new mobile money users—and expanding the mobile technology sector.

Afghan officials say the enthusiasm generated by the contest and subsequent avalanche of ideas bodes well for future uptake of mobile money in Afghanistan given the country’s demographics. With two-thirds of Afghans age 25 years or younger, Afghanistan is truly a land of potential early adopters.

“The contest on mobile money is a creative approach to get our youth involved in new technology that will spur the development and economic growth of Afghanistan,” said Deputy Minister of Higher Education Sabir Khishky.

More Independence, Efficiency

Hakima* was born in 1992 in Iran, where her family took refuge during Afghanistan’s brutal civil war and subsequent oppression by the Taliban. Like so many other Afghans who aspire to contribute to their country’s rebuilding, Hakima moved back to Afghanistan with her family in 2002. She became a math teacher at a local school for girls in Nimroz province before enrolling in Kabul University, where she is studying pharmacology.

Upon learning about mobile money, Hakima immediately recognized its potential use for Afghan businesswomen, who are constrained by having to hire external agents or rely on male family members to conduct basic financial transactions such as making payments and storing money safely.

Hakima, whose app contest entry helps Afghan businesswomen get easy access to their money, was one of the eight winners to take home a $5,000 cash prize, win computer equipment for her school, and see a major mobile network operator develop and deploy her app.

Hakima noted that using local retail stores as “banks,” or mobile money agents, and using a mobile phone for transactions would not only save time and money that could be invested back into an individual’s business, but would also give women entrepreneurs greater independence in making basic business decisions. Many Afghan women who put their handicrafts on the market do not have the permission of their husbands or other male family members to open bank accounts. This app enables them to pay their suppliers and receive payments from retailers using this secure mobile transaction.

And, like their male counterparts, Afghan businesswomen will benefit greatly from the ability to deal with more customers in less time and across distances.

“Mobile money means women no longer have to ask permission just to go to the bank, no longer have to wait in line for hours to withdraw money, pick up or repay loans,” Hakima said. “All of these transactions can be conducted safely and comfortably from home. Moreover, mobile money will give women better control over their own money to support their businesses and families.”

Afghan Wireless, one of the four mobile service providers operating in Afghanistan, will be deploying the app for Afghan businesswomen. And since Hakima intends to use her prize money to help launch a small enterprise, she’ll soon have the opportunity to know if her idea works as well in practice as in theory.

From Long Lines to Seamless Transactions

Sami* an economics student at Nangahar University, plans to use his prize money to help finance his graduate studies. Sami’s winning idea stems from his own frustrating experience trying to pay a government fee for his passport application. While waiting in line for hours in the scorching sun in front of the bank, Sami looked at scores of others lined up to pay their bills. “There’s got to be a more efficient way to do this,” Sami told himself.

Soon after, he heard about the mobile payment system and immediately thought of a multitude of potential uses for a government payment app. For Sami, paying passport fees electronically from a mobile handset is just the tip of the iceberg.

Electricity bill payment via mobile phone has just been introduced in Afghanistan.

“Not only will mobile payments improve efficiency and a much-needed increased revenue to the government, but it will also instill transparency into the system so that Afghans will know where their money is going. This is a key step toward reducing corruption,” he said. Roshan’s M-Paisa (mobile money) service will be designing and deploying Sami’s app.

“Today, some 15 million Afghans use mobile phones, and a full 85 percent of the population lives within the combined network coverage of the four major telcos,” said USAID Administrator Rajiv Shah last year. “This technological leap connects Afghans to each other and to the economy in ways that were unimaginable just a few years ago.”

Afghanistan represents an important test case. International assistance to the country represents a significant percentage of Afghanistan’s GNP, so encouraging the use of mobile money by the national government and international donors for their payments is key. Moreover, USAID is already applying the lessons learned from Afghanistan to other markets including Malawi, the Philippines and Haiti. Afghanistan will offer important insights on how to expand mobile money beyond government payments in other countries, USAID officials believe.

“Our commitment to Afghanistan is very high and it is critical that we get this right,” said Priya Jaisinghani, director of mobile solutions at USAID. “Our work in mobile money around the world draws on the Afghanistan experience—both successes and challenges—and our hypothesis that governments play a critical role in facilitating adoption of mobile money.”

*Last name withheld for privacy reasons.

Comment

Make a general inquiry or suggest an improvement.